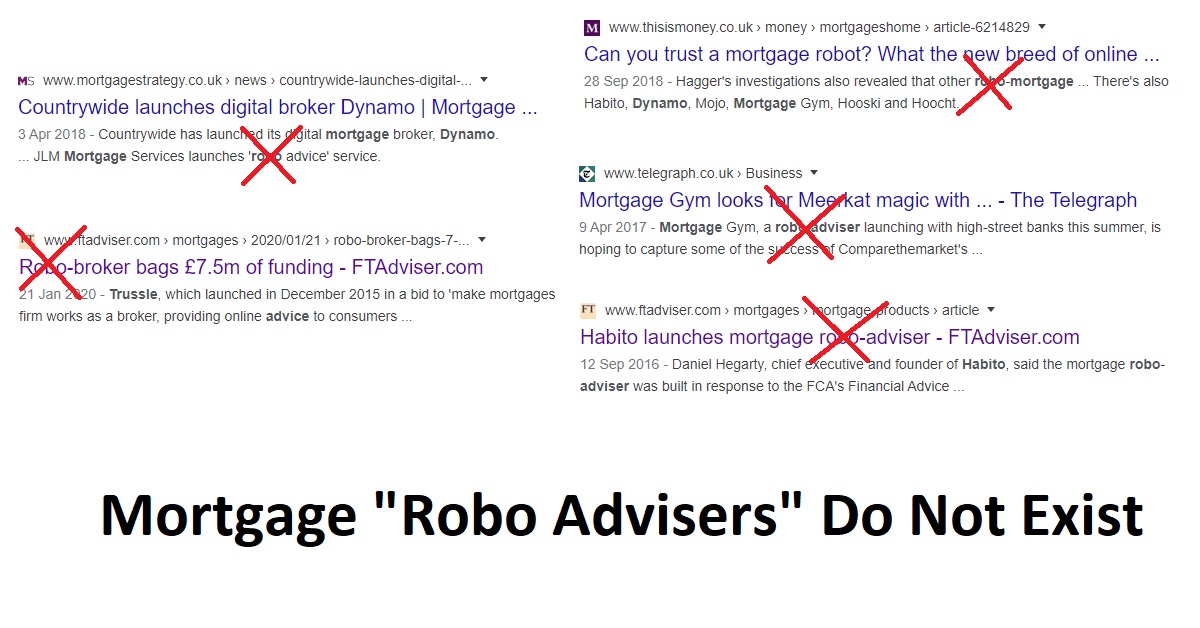

Mortgage Robo Advisers Do Not Exist (2020)

The Mortgage Press did not report it. The Financial Conduct Authority (FCA) did not morn it. We’ve today learned that RoboAdvice has died.

A List of Mortgage RoboAdvisers usually includes:

- Habito

- Trussle

- Cyborg Finance

- MortgageGym

- Hoocht

- Mojo Mortgages

- Dynamo

- Dashly

- Burrow (Dwell)

To be a Robo Adviser, you need a Robo to give Advice. Except behind every “RoboAdviser” listed here is real humans with CeMap giving recommendations.

Habito

When Habito launched in 2016 1 it was described as “automated advice process that attempts to map out the next five years of finances, and makes a recommendation”. The Financial Times reported “Habito launches mortgage robo-adviser” and clients only have to speak to a broker to accept the Advice. The FT went on to outline Habito “will be developed after a few months, so clients do not have to speak to a broker”.

This is a complete contrast to the Habito in 2020, with the homepage saying “Humans that work for you”. In 2016 the perception was a Robot was giving the Advice. In 2020 its Habito’s “amazing mortgage brokers, who will find you the very best deal and do the hard work to get your mortgage over the line”.

Habito is no longer a RoboAdviser, its humans that are doing the Advice. Habito now refers to itself as a Digital Mortgage Broker 4 with the online process being a Fact Find.

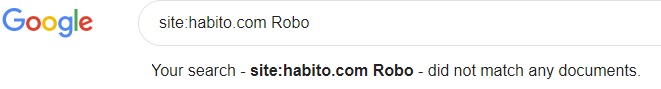

You can not even find the word “Robo” on Habito’s website anymore.

Trussle

A once described Robo-Broker 9 with millions in funding to “disrupt” the market. Trussle is likewise an online fact find with humans at the other end. The homepage outlining “your personal mortgage adviser will send you a deal”.

Cyborg Finance

The clue with Cyborg Finance is in the name. A Cyborg is a person who’s abilities are extended before usual human limitations by technology. It’s not Robo but a Human Adviser aided by technology. It goes out to say “Technology assists our advice, technology does not make our advice.” 11.

MortgageGym

MortgageGym, a once described RoboAdviser with millions in funding 12. Now on its homepage, has the headline “Online mortgage service with real advisers” 8. There is nothing robotic about real advisers.

Hoocht

Hoocht a “real-time mortgage advice platform using chatbots to handle customer conversations, which are followed by automatically-generated mortgage and borrowing capacity illustrations”5 . Hoocht closed in 2019

Burrow (Dwell)

Burrow Mortgages chief executive Pradeep Raman says: “We don’t see ourselves as a robo-adviser” Dwell customers can either speak to advisers on the telephone or over WhatsApp to collect outstanding information. Dwell was renamed Burrow and then closed. No longer a broker, Burrow is now software other mortgage brokers can use for onboarding clients.

Mojo Mortgages

The press may have put it in the same category as those claiming to be RoboAdvisers but with Mojo Mortgages “You’ll be asked to book an appointment with a mortgage adviser after completing an online form” 6.

Dynamo

Dynamo is another online Fact Find and Mortgage Adviser will call you back service. As it describes itself an “easy online enquiry coupled with a dedicated and experienced team” 7

Dashly

Dashly is “champions of human, whole-of-market advice” 10. It’s precise technology, but real humans are required to check the indicative remortgage on offer.

The Conclusion

This post frequently links to The Financial Times (FT) as they reported about “disrupting” mortgage advice. Unfortunately, it’s just marketing for new Mortgage Broker Brands. Behind every “RoboAdviser” listed here are real humans with CeMap giving recommendations.

They do have excellent onboarding Technology. Though that is just an online Fact Find, Bespoke Finance had that in 2015. Though not as eloquent as those available today.

The Future

The FCA in its 2016 Financial Advice Market Review (FAMR) said it wanted availability of automated, or ‘robo’ financial Advice 14.

The FCA has made moves to make Execution Only easier. This would not be “RoboAdvice” but “RoboExecution”. As detailed in the CP19/17 consultation paper. The FCA’s PS18/27 also made it easier for like-for-like remortgages to be execution-only.

So it’s not unexpected that we may eventually see some kind of RoboBroker. Though given the emphasis on humans in these Online Brokers marketing (Habito: “Humans that work for you”, Trussle: ““personal mortgage adviser”).

Do clients want a robot? Or a Human?

Those said said Robot before, seem to have changed their minds..