What is a Mortgage Calculator?

What is a Mortgage Calculator?

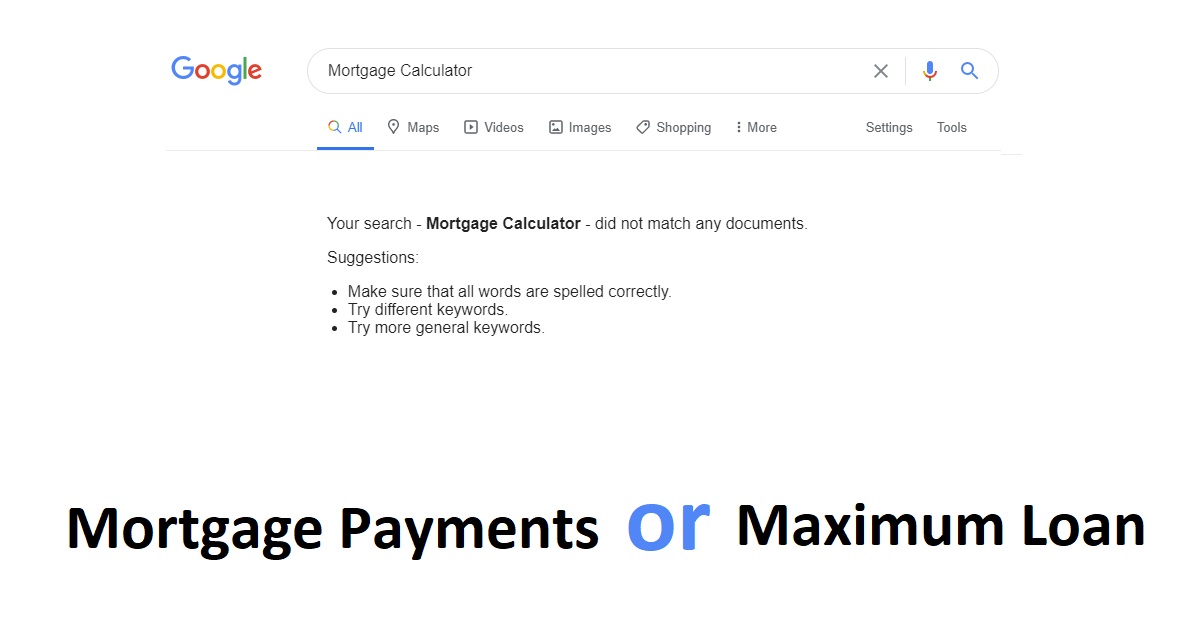

Every day on Google 27,433 people search for “Mortgage Calculator”. As the term is so vague, it has puzzled me. What are they trying to Calculate?

Is it Maximum Borrowing (Affordability) like Virgin Money provides. Otherwise, Monthly Mortgage Payment like Citizens Advice provides.

Wikipedia says:

Mortgage calculators are used by consumers to determine monthly repayments

I’m not sure…

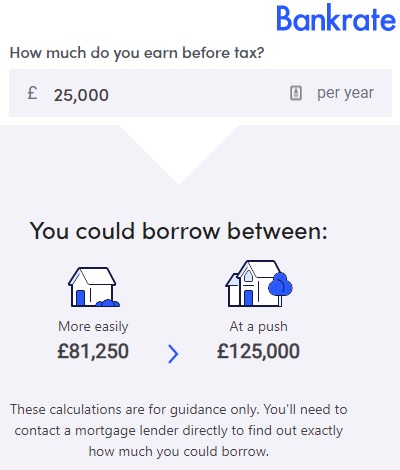

Affordability Calculator

You use this calculator to find out the maximum mortgage achievable. You would typically provide the system with:

- Monthly Income

- Monthly Household Expenditure

- Monthly Credit Commitments

Enter this into a simple formula to be provided with a maximum mortgage amount. It uses a persons income to estimate the maximum a bank would lend.

When searching “Mortgage Calculator,” these companies have a tool which provides this function Bank Rate, Virgin Money and Principaliity.

NOTE: These calculators are flawed instruments. They are mostly a rough guide, a budget with a multiplier. Not the Affordability Calculators Intermediaries Use.

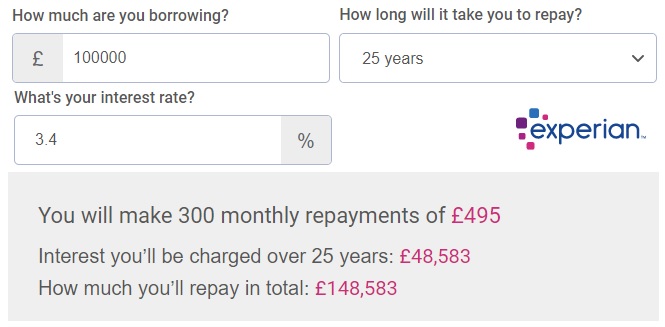

Mortgage Payment Calculator

You use this calculator to find out your monthly mortgage payments. You would typically provide the system with three things:

- Mortgage Amount

- Mortgage Term

- Interest Rate

Enter this into the PMT Function to be provided with your monthly mortgage payment.

When searching “Mortgage Calculator,” these companies provide this function Confused, LandC, Knight Frank, Alexander Hall, Mortgages for Business, Experian and Citizens Advice

NOTE: These calculators are flawed instruments. Most do not have allowances for different types of rates, Introductory Rates and Standard Variable Rates (SVR).

Mortgage Payment & Product Calculator

You use this calculator to find out your monthly mortgage payments for each lender. You would typically provide the system with three things:

- Purchase Price

- Mortgage Amount

- Mortgage Term

Unlike the “Mortgage Payment Calculator,” you do not enter an interest rate. Instead Just Mortgages puts the information into Mortgage Sourcing Software. It provides mortgage payments as calculated for several lenders products.

Other companies do the same but only for their mortgage range Danske Bank, Post Office, Co-Operative Bank and Coutts.

So, What are people trying to Calculate?

It’s not “Mortgage Payments”

Searching Google for “Mortgage Calculator” gives you mostly Mortgage Payment Calculators. Except there are few reasons, anyone would want this. Especially not 27,433 people a day. Consumers are always told the monthly payments on ESIS or KFI’s. It would be rare to have on hand just the interest rate, mortgage amount and term without also having the mortgage payment.

By providing this calculator, I believe most companies are responding to consumer intent wrong.

It’s reasonable for Citizens Advice to have it, so Consumers can confirm they are paying the correct amount. I can not see clients of lenders or mortgage brokers would needing it (more than the alternatives).

NOTE: Nothing wrong in having this calculator. It’s just not what people are looking for en-mass.

It’s maybe “Mortgage Payment & Product Calculator.”

These are not “really” Calculators at all. Given the Mortgage Amount and the Loan-to-Value (LTV). The user is shown a simple mortgage comparison. Suppose a users intent was to compare mortgages. It would likely be a completely different search term such as “Compare Mortgages”. Not “Mortgage Calculator”.

Perhaps this may be the intent of a fraction of the 27,433 daily searches. Even if not, I imagine most will be happy with the results showing real mortgages available and what they would cost. However, it does nothing for eligibility on affordability.

It’s Probably “Mortgage Affordability Calculator”

The other option(s) seem a rare use case. It’s more likely a person, at the start of there mortgage journey, wants to know how much they can borrow.

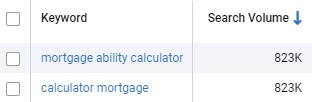

The data also shows this to be the case. Google Searches for “Mortgage Calculator” and “Mortgage Ability Calculator” is on par. They both receive 27,433 searches a day. I would suggest after searching “Mortgage Calculator” and not finding the desired results. People search “Mortgage Ability Calculator” instead.

Tell me I’m wrong

My theory is that people searching Google for “Mortgage Calculator” are not getting what they want. The results are polluted with Mortgage Payment Calculators.

I may be wrong. I’m just applying logic and rough search data. Tell me on LinkedIn or Twitter.

Consumers use a Mortgage Calculator to find out:

— Adam Hosker (@Adam_Hosker) August 18, 2020

Best Mortgage Calculators

I looked at quite a few Mortgage Calculators for this, here is the best (I’ve found) given the search intent.